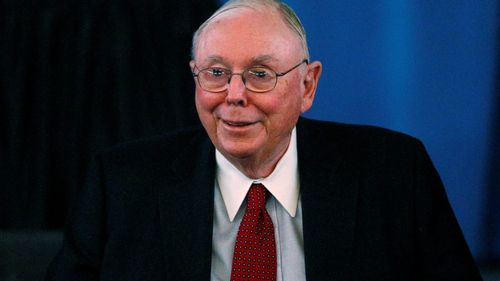

Charlie Munger's Mental Models That Helped Build His ‘30-Second Mind’

Dec 29, 2023 · 2 mins read

0

Share

Warren Buffett once said that his business partner, the late Charlie Munger, has a 30-second mind. Buffett said "Charlie has the best 30-second mind in the world. He goes from A to Z in one go. He sees the essence of everything even before you finish the sentence."

Save

Share

Charlie Munger was famous for advocating a "latticework of mental models". "Eighty or ninety important models will carry about 90 percent of the freight in making you a worldly-wise person. And, of those, only a mere handful really carry very heavy freight," said Munger.

Save

Share

These models should come from various disciplines, such as microeconomics, psychology, engineering & physics because all the wisdom of the world is not to be found in one little academic department--and these models can be used to quickly gauge a situation and respond to it.

Save

Share

Munger warned about relying on one mental model because then the human mind will distort reality to fit into that mental model. People trained in one model will try to solve all problems with that model. Mental models from various disciplines help a person avoid blind spots.

Save

Share

He said "You know the old saying: to the man with a hammer, the world looks like a nail. This is a dumb way of handling problems." If a mental model were a window into one perspective, using different models gives different perspectives and hence gives a complete picture.

Save

Share

Collector of bad-judgment calls, He was so influenced by algebraist Carl Jacobi who said "Invert, always invert." He sought good judgment mostly by collecting instances of bad judgment and then pondering ways to avoid such outcomes.

Save

Share

“It involves starting from the end. That is, looking at an outcome and seeing how to get there or looking at an adverse outcome and seeing how to avoid it. All I want to know is where I'm going to die, so I'll never go there," he said.

Save

Share

Therefore, if you want to retire comfortably, you don't just think about how to do that. But think about the things to avoid retiring in penury--for example, avoid bad spending habits, avoid investing in risky get-rich-quick schemes and so on.

Save

Share

Munger on diversification: Diversification makes sense if you don't know what you're doing and aren't embarrassed to admit it. But he thought the better way was to choose a few good securities and invest only when you have "extra knowledge" than the market.

Save

Share

Munger’s philosophy is to stay within your “circle of competence.” This means focusing on areas where you deeply understand and avoiding those where your knowledge is limited. You can make informed decisions and mitigate potential risks by staying within your circle.

Save

Share

0